By Jessica Anstice

A property insurance and Bushfire Attack Level (BAL) Ratings information session will be held in Upper Beaconsfield ahead of the fire season.

Upper Beaconsfield Association (UBA) is hosting the session in conjunction with the Upper Beaconsfield Fire Brigade on Wednesday 4 December.

The session aims to help residents understand bushfire risk, BAL ratings, the recommended insurance coverage in a bushfire-prone area.

A guest speaker from the Insurance Council of Australia will speak about insurance, protecting your property and the real cost of rebuilding.

An expert will also share their experience about determining BAL levels and a builder will be on hand to discuss the challenges of rebuilding in a bushfire-prone area, in particular outlining compliance to the new building standards that need to meet the new BAL rating.

“People are not aware of the cost of clearing a site which can be up to $60,000. If you haven’t got that right insurance, you’re putting yourself at risk,” UBA president Caroline Spencer said.

“The session will help people understand that should they lose everything in a bushfire, what they need to prepare for.”

After weeks of preparation, Ms Spencer recognised she should check her own property insurance policy before discovering she was under-insured.

“We thought that we were over-insured, but turns out we were under-insured so we’ve upped our insurance,” she said.

“Most people are under-insured and don’t have enough to rebuild in the way they would like to.”

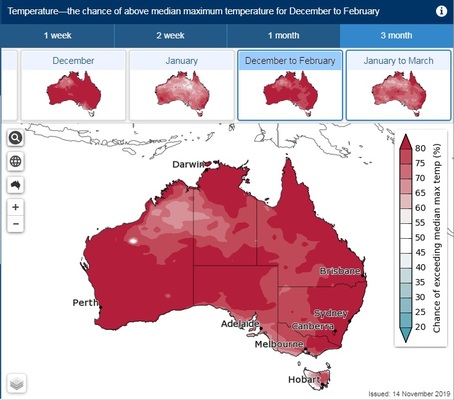

Upper Beaconsfield resident Malcolm Graham, who is also heavily involved in organising the session, believes the area is looking towards the possibility of another “nasty” fire season.

“For some of the areas, as it has been said, it’s not a case of whether it will; it’s only a case of when,” Mr Graham said.

“One of the biggest issues for most people is after the event, they find out they’re not insured which can completely unbalance a family – there’s been people commit suicide, there’s been families broken up and families that can’t go back together through loses.

“What I decided to do was have a bit of a chat to a few people and to my amazement their knowledge was very little in relation to what is quality insurance and that is to know that you are insured properly.”

It’s yet to be determined whether the information session will be held at the Upper Beaconsfield Community Centre or the local primary school but it will commence at 7pm.